Directors who do not fully understand the complex duties they owe to the companies they serve expose themselves to a risk of personal liability. That was certainly so in the case of two honest businessmen who unwittingly made unlawful distributions from their company’s reserves prior to its insolvency.

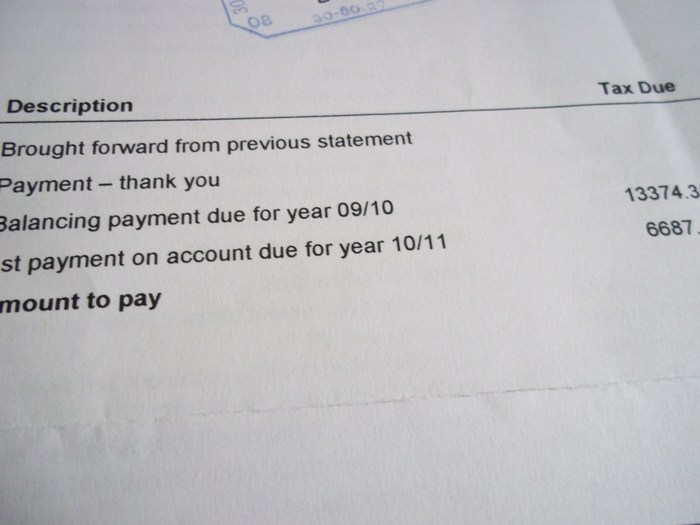

When it entered liquidation, the company owed over £1.7 million to HM Revenue and Customs. Its two directors – who owned 80 per cent of its shares – had some years previously entered into profit extraction schemes whereby the company’s reserves were stripped out, principally via employee benefit trusts (EBTs), with an ultimate view to distributing them to shareholders.

After the company’s liquidators launched proceedings, the High Court noted that one of the former directors had testified that he saw no distinction between what was right for the shareholders and what was right for the company. The purpose of the EBTs was to make withdrawals from the company’s capital reserves in a tax-efficient manner for the benefit of shareholders.

Non-shareholder employees received no benefit and none of the distributions were reasonably incidental to the carrying on of the company’s business. They were not supported by board resolutions or minutes recording that the company’s overall financial position had been considered. The required formalities not having been complied with, the distributions were unlawful and void. The Court’s ruling opened the way for the liquidators to seek repayment of the sums so distributed for the benefit of the company’s creditors.

The Court acknowledged that its decision might appear harsh to the former directors, who were found to have acted honestly. Having failed to take independent legal advice, they had been seduced by the prospect of tax-free distributions into taking a risk they did not entirely understand.